REPORTING OF DEPOSITS AND EXEMPTED DEPOSITS IN DPT-3

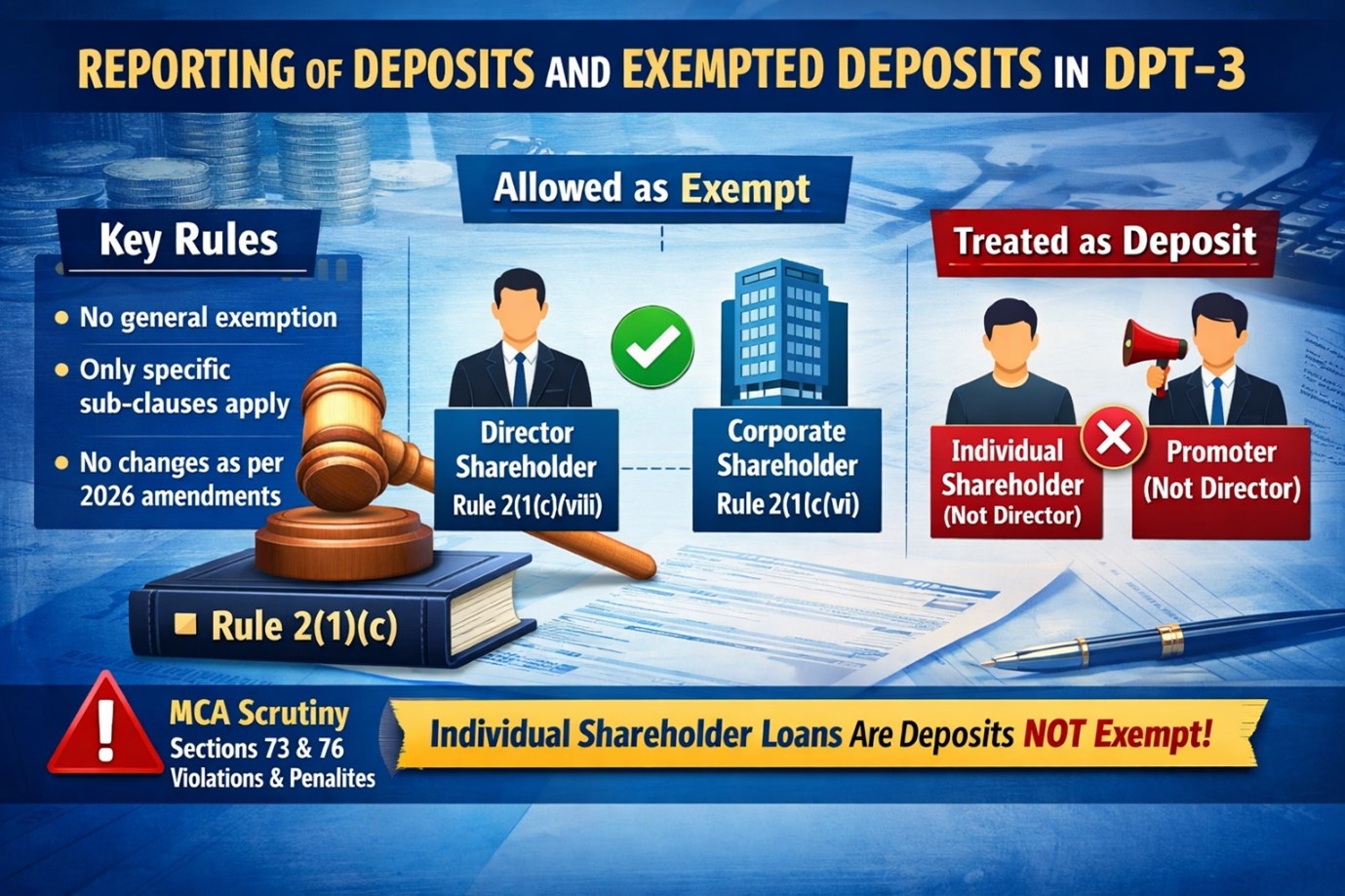

Companies are required to report all deposits and certain exempted deposits in e-Form DPT-3 under the Companies (Acceptance of Deposits) Rules, 2014. A common area of confusion is how to report loans taken from shareholders whether they are treated as deposits or exempted deposits. Proper classification is crucial to avoid penalties and compliance issues.

Where to Report Loan Taken From Shareholders in DPT-3?

Loans taken from shareholders are not automatically exempt under the Companies Act. The reporting depends on whether the loan fits specific sub-clauses of Rule 2(1)(c). Loans that do not fall under these sub-clauses are treated as deposits and must be reported as such in DPT-3. This applies especially to private companies, where non-director shareholder loans are allowable under exemptions but reported as deposits, not exempt.

Relevant Provision

The key provision is Rule 2(1)(c) of the Companies (Acceptance of Deposits) Rules, 2014.

Key Legal Position:

There is no general exemption for loans from shareholders under Rule 2(1)(c).

A shareholder loan is reportable as “not considered as deposit” only if it fits into a specific sub-clause of Rule 2(1)(c). No changes in 2026 amendments alter this core rule.

Applicable Sub-Clauses You Can Actually Use

- Rule 2(1)(c)(viii) – Amount received from a Director

Use this only if:

- The shareholder is also a Director of the company.

- A declaration is obtained stating that the money is from the director’s own funds.

DPT-3 field to select: “Amount received from a director”

Example:

If Mr. A is a shareholder and also a director, and he lends INR 50 lakh from his personal funds, it can be reported as exempt.

- Rule 2(1)(c)(vii) – Inter-corporate loans

Applicable only if the shareholder is a body corporate.

Note: Corrected clause reference to (vi) for amounts from other companies, but (vii) aligns for specifics.

Eligible cases:

- Holding company

- Associate company

- Any other corporate shareholder

DPT-3 field to select: “Loan received from any other company”

Example:

If XYZ Pvt. Ltd., a corporate shareholder, lends INR 1 crore, it can be reported as exempt under this clause.

What you CANNOT select

There is no separate field or clause in DPT-3 for:

- Loan from shareholder (individual)

- Member’s loan

- Promoter loan (if not director)

Loans From Individual Shareholders Who Are NOT Directors:

- Do not fall under Rule 2(1)(c)

- Are technically “deposits”

- Should NOT be reported as exempt in DPT-3

How Such Cases Are Handled in Practice

Shareholder Status | Clause under 2(1)(c) | DPT-3 Reporting |

Director + shareholder | 2(1)(c)(viii) | Allowed as exempt |

Corporate shareholder | 2(1)(c)(vii) | Allowed as exempt |

Individual shareholder (non-director) | None | Treated as deposit |

Promoter but not director | None | Treated as deposit |

Compliance Risk Alert

Incorrectly classifying shareholder loans as exempt in DPT-3 is a common point of MCA scrutiny. This can trigger:

- Violations under Section 73/76 of the Companies Act

- Penalties on the company and its officers

Best practice: Always check if the shareholder is a director or corporate entity before claiming exemption. For private companies, confirm exemption applicability.

Conclusion

Loans from shareholders in DPT-3 must be carefully classified to ensure compliance. Only loans from directors or corporate shareholders can be treated as exempt deposits under Rule 2(1)(c). All other loans, including those from individual shareholders or promoters who are not directors, are considered deposits and must be reported accordingly in private companies. Accurate reporting helps the company avoid penalties and MCA scrutiny under Sections 73 and 76.

Get Expert Assistance

Related Articles

Compliance Related to Unspent CSR Amount: Deposit, Transfer, or Spend? The Real Rules

Compliance Related to Unspent CSR Amount: Deposit, Transfer, or Spend? The Real Rules GSTR-3B New Rules from Jan 2026: Full GST Guide

GSTR-3B New Rules from Jan 2026: Full GST Guide Undisclosed Foreign Assets: What Taxpayers Need to Know under Budget 2026–27

Undisclosed Foreign Assets: What Taxpayers Need to Know under Budget 2026–27 Large Value Funds (LVFs): SEBI’s 2025 Reforms and Their Impact on Institutional Capital

Large Value Funds (LVFs): SEBI’s 2025 Reforms and Their Impact on Institutional Capital Key Clauses of a Partnership Deed in India

Key Clauses of a Partnership Deed in India

Recent Articles

Compliance Related to Unspent CSR Amount: Deposit, Transfer, or Spend? The Real Rules

Compliance Related to Unspent CSR Amount: Deposit, Transfer, or Spend? The Real Rules GSTR-3B New Rules from Jan 2026: Full GST Guide

GSTR-3B New Rules from Jan 2026: Full GST Guide Undisclosed Foreign Assets: What Taxpayers Need to Know under Budget 2026–27

Undisclosed Foreign Assets: What Taxpayers Need to Know under Budget 2026–27 Large Value Funds (LVFs): SEBI’s 2025 Reforms and Their Impact on Institutional Capital

Large Value Funds (LVFs): SEBI’s 2025 Reforms and Their Impact on Institutional Capital Key Clauses of a Partnership Deed in India

Key Clauses of a Partnership Deed in India

FAQ

Can loans from any shareholder be reported as exempt in DPT-3?

How should a loan from a director-shareholder be reported?

How should a loan from a corporate shareholder be reported?

What about loans from individual shareholders who are not directors?

What are the risks of incorrect reporting?

Contact Us

- 50, Bright Arcade, 12th Main Rd, 4th T Block East, KV Layout, Jayanagar, Bengaluru – 560011, Karnataka

- +91 97397 36999

- mgmt@chhotacfo.com

Useful Links

©2024.CHHOTA CFO - All rights reserved