Change in Directors of a Company

To guarantee that the company’s daily activities are carried out effectively, directors are typically chosen by the company’s shareholders in accordance with the applicable provisions of the Companies Act 2013. They have a fiduciary duty to the business and its shareholders, which means they are in charge of managing business affairs in a way that ensures success and profitability while also boosting the business’s reputation and image.

Any time, as and when necessary, a company’s board of directors may change. Either demand or voluntary change is possible. The need for an expert on the board or due to other circumstances arises

How are directors appointed by a company?

- A new Director can be appointed to the company by the Board of Director by passing an ordinary resolution in an Extraordinary General Meeting or an Annual General Meeting. It is mandatory for any individual who is to be added as a Director of the company for the first time to get DIN or Director Identification Number issued by the Ministry of Corporate affairs after submitting necessary documents.

- As per the law, minimum of 3 directors in case of a public limited company, minimum 2 directors for a private limited company and minimum 1 director in case of a one-person company. A company can have a maximum number of directors of a private company is 15. The company could appoint one or more directors through passing the special resolution in its Board meeting or general meeting.

- For a public limited corporation, the director is chosen by two-thirds of the shareholders, and the remaining directors are chosen in accordance with the company’s bylaws. 1/3 of the total number of directors make up the remaining group.

- When making an appointment for a private limited company, consideration is given to the clauses outlined in the firm’s articles of organisation. The shareholders are responsible for appointing the directors if there are no provisions relating to this.

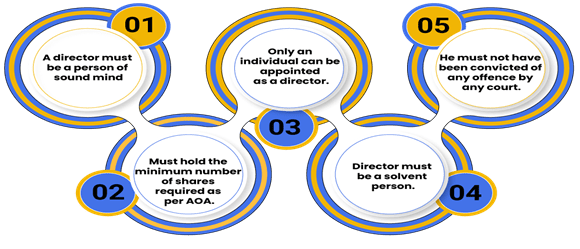

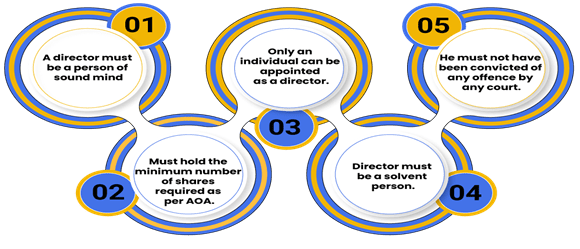

Eligibility Criteria for Appointment of Directors (Change in Directors)

Resignation of a Director (Section 168 of the Companies Act 2013)

When a director notifies the firm in writing of his intention to resign, the resignation may be taken into consideration. After receiving the director’s notice, the board of directors is required to inform the shareholders in the general meeting by presenting the information. The information about the director’s resignation must be included in the report of the directors that is presented to the shareholders at the general meeting. Additionally, the Company is required to submit Form DIR – 12 to the Registrar within 30 days after the resignation date. The effective date of resignation here will be the latest of:- The date on which the notice is received by the company.

- The date specified in the notice.

Removal of a Director (Section 169 of the Companies Act 2013)

Removal only happens before the expiry of the director’s term. This can be made possible by passing an ordinary resolution at the General Meeting of the shareholders, but only after giving the director a reasonable opportunity of being heard.A) Notice of the resolution

- A notice of the resolution for the removal of the director will be circulated to all the necessary persons at least 7 days prior to the meeting.

- Where the notice cannot be delivered due to unavoidable circumstances:-

- It can be published in the newspapers. (One in English and the other one in the regional language)

- The notice must be posted on the company’s website.

- Once this notice is received, the company shall send a copy to the concerned director.

- He will be entitled to be heard at the General Meeting where the resolution is to be passed.

B) Written Representation

– A representation against his removal may be made in writing by the director. – He may further request that the representation be circulated to all the members. – A notice regarding the same will have to be issued to the members. – Where circulation is not possible, he may request it to be read at the meeting.C) Filing with the ROC

Form DIR – 12 has to be filed with the Registrar within 30 days from the date of resignation of the director along with the prescribed fees and the necessary attachments.Form DIR – 12

This form has to be filed with the particulars of appointment of directors and key managerial personnel and the changes among them. The details mentioned below have to be entered in:- Details of the company.

- Details regarding the number of directors, managers etc.

- The date of cessation or the date of appointment, as the case may be.

- Respective DINs and DSCs to be affixed wherever necessary.

Attachments:

- Declaration of the director to be appointed.

- In case of removal/resignation-

- Notice of resignation.

- Evidence of cessation.

- Any other optional attachments.

Form DIR – 11

This form is to be filled for the purpose of giving notice of resignation of the director to the Registrar. The following details have to be entered in:- Details of the company.

- DIN of the resigning director.

- Date of filing the resignation with the company.

- Reasons for the resignation.

- Attachments