MSME CLASSIFICATION

INTRODUCTION :

Micro, Small and Medium Enterprises (MSME) sector has emerged as a highly vibrant and dynamic sector of the Indian economy over the last five decades. MSMEs not only play crucial role in providing large employment opportunities at comparatively lower capital cost than large industries but also help in industrialization of rural & backward areas, thereby, reducing regional imbalances, assuring more equitable distribution of national income and wealth. MSMEs are complementary to large industries as ancillary units and this sector contributes enormously to the socio-economic development of the country.

The MSME registration is at the option of the Business owners as the benefits in terms of taxation, setting up the business, credit facilities, loans etc shall be availed in the hands of them.

WHAT IS MSME CLASSIFICATION?

Initially, when the government introduced the MSME registration in 2006, the MSME classification was based on the investment criteria in plant and machinery or equipment. The government revised the MSME classification by inserting composite investment and annual turnover criteria. Also, the distinction between the manufacturing and the services sectors under the MSME definition was removed.

The following is the current revised MSME classification, where the investment and annual turnover are to be considered for deciding if an entity is considered as an MSME:

| CLASSIFICATION | MICRO | SMALL | MEDIUM |

| Manufacturing Enterprises and Enterprises rendering Services | Investment in Plant and Machinery or Equipment: Not more than Rs.1 crore and Annual Turnover | Investment in Plant and Machinery or Equipment: Not more than Rs.10 crore and Annual Turnover | Investment in Plant and Machinery or Equipment: Not more than Rs.50 crore and Annual Turnover |

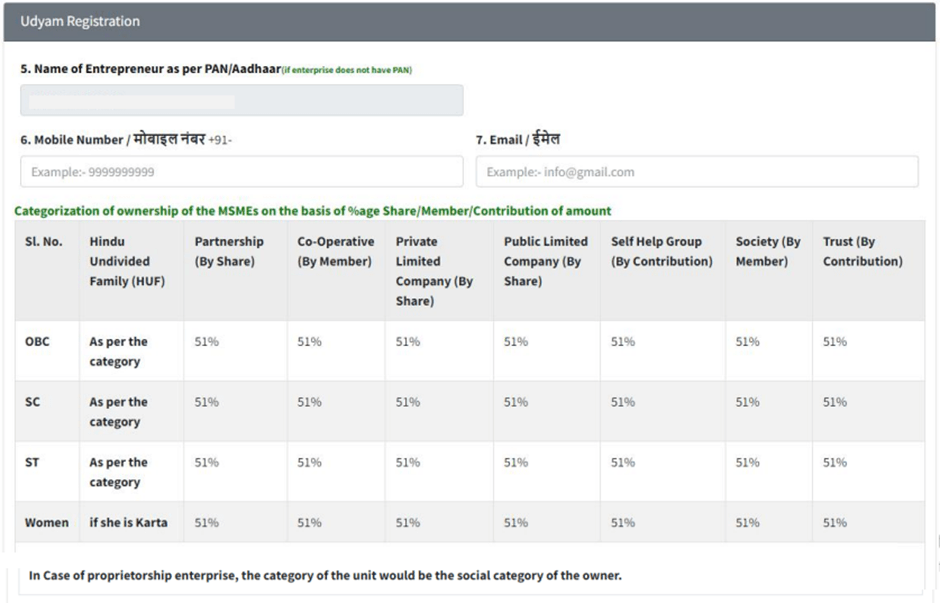

The MSME registration documents and other information are as follows:

- Aadhaar card

- PAN card

- Mobile Number

- E-mail id

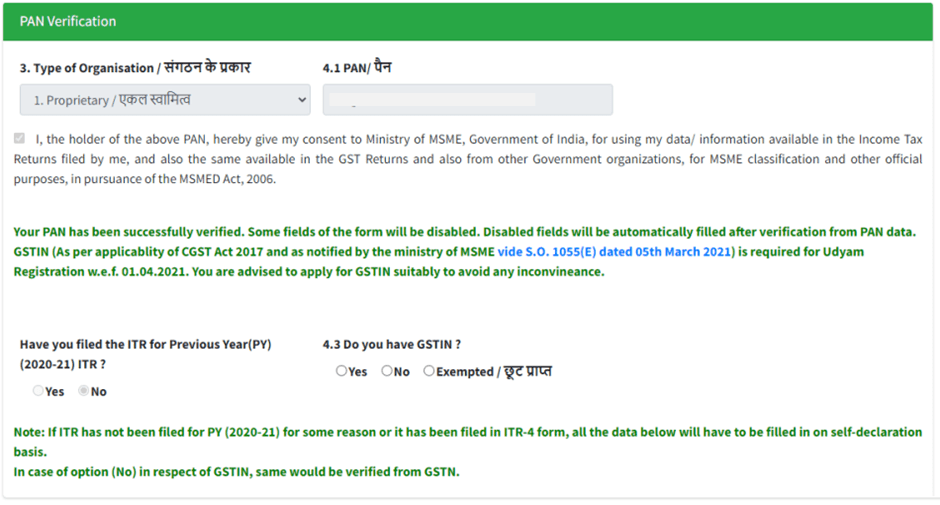

PAN and GST-linked details on investment and turnover of enterprises will be taken automatically by the Udyam Registration Portal from the Government databases since the portal is integrated with Income Tax and GSTIN systems.

HOW TO APPLY FOR MSME REGISTRATION ON UDYAM REGISTRATION PORTAL?

MSME registration helps the Micro, Small and Medium (MSME) industries to obtain various benefits provided by the government for their growth. In a developing country like India, MSME industries are the backbone of the economy. When these industries grow, the country’s economy grows and flourishes. These industries are also known as small-scale industries or SSIs.

The MSME registration is not yet made mandatory by the Government of India but it is beneficial to get one’s business registered under this because it provides a lot of benefits in terms of taxation, setting up the business, credit facilities, loans etc.

HOW TO APPLY FOR MSME REGISTRATION ON UDYAM REGISTRATION PORTAL?

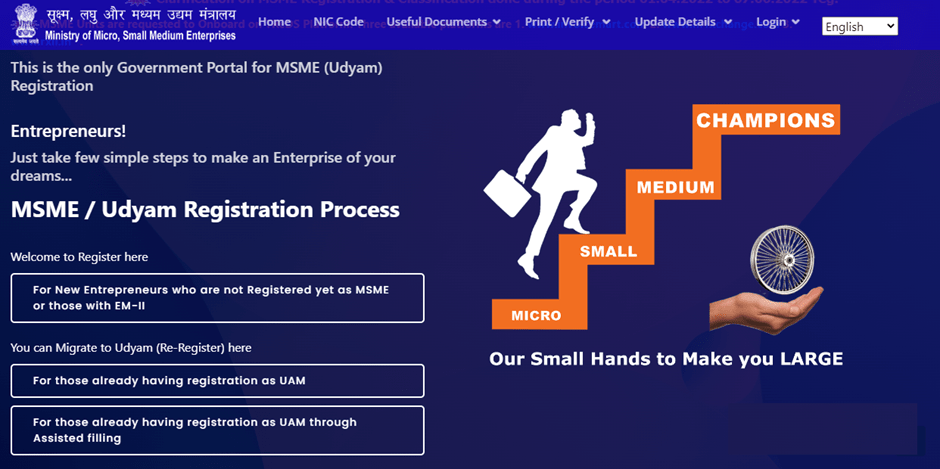

The MSME registration process is entirely online. MSME online registration is to be done on the government portal of udyamregistration.gov.in. There is no MSME registration fee charged for registration. MSME registration online can be done under the following two categories in the portal –

For New Entrepreneurs who are not Registered yet as MSME or those with EM-II and

For those having registration as UAM and For those already having registration as UAM through Assisted filing

Step 1:

New entrepreneurs and entrepreneurs having EM-II registration need to click the button “For New Entrepreneurs who are not Registered yet as MSME or those with EM-II” shown on the home page of Udyam Registration Portal.

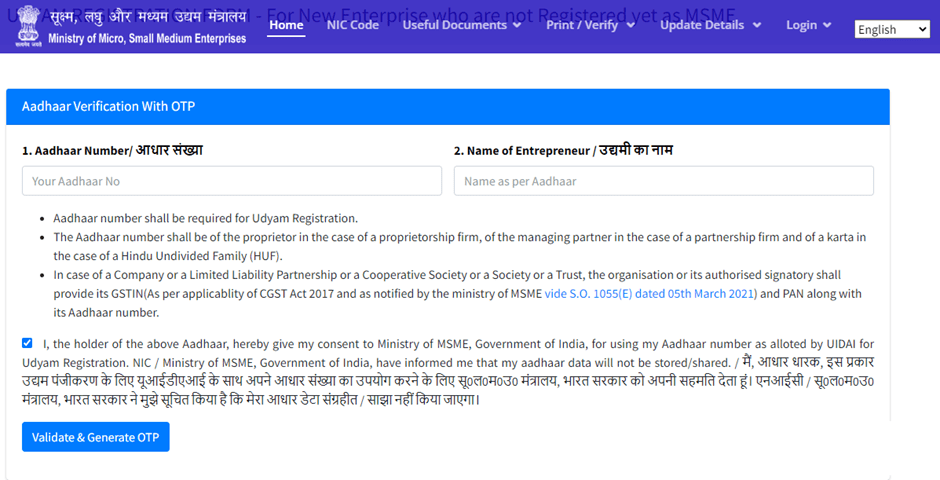

Step 2:

On the next page, enter the Aadhaar number and the name of the entrepreneur and click on the “Validate and Generate OTP Button”. Once this button is clicked and OTP is received and entered, the PAN Verification page opens.

Step 3:

The entrepreneur must enter the “Type of Organisation” and the PAN Number and click on the “Validate PAN” button. The portal gets the PAN details from the government databases and validates the PAN number of the entrepreneur.

Step 4:

After verification of PAN, the Udyam Registration form will appear, and the entrepreneurs need to fill in their personal details and details of their enterprise.

Step 5:

Enter the investment and turnover details, select the declaration, and click on the “Submit and Get Final OTP” button. The OTP is sent, and after entering the OTP and submitting the form, the Udyam Registration Certificate will be sent through email. Entrepreneurs can also find out the MSME registration status from the Udyam Registration Portal.

REGISTRATION FOR ENTREPRENEURS ALREADY HAVING UAM:

For those already having UAM registration, they need to click the button “For those having registration as UAM” or “For those already having registration as UAM through Assisted filing” shown on the home page of the government portal. This will open a page where Udyog Aadhaar Number is to be entered, and an OTP option should be selected.

The options provided are to obtain OTP on mobile as filled in UAM or obtain OTP on email as filled UAM. After choosing the OTP Options, “Validate and Generate OTP” is to be clicked. After entering OTP, registration details are to be filled on the MSME registration form, and Udyam registration will be complete.

BENEFITS OF MSME REGISTRATION:

- Due to MSME Registration India, bank loans become cheaper as the interest rate is very low, around 1-1.5%, much lower than interest on regular loans

- It also allowed credit for minimum alternate tax (MAT) to be carried forward for up to 15 years instead of 10 years

- Once registered the cost of getting a patent done, or the cost of setting up the industry reduces as many rebates and concessions are available

- MSME registration helps to acquire government tenders easily as Udyam Registration Portal is integrated with Government e-Marketplace and various other State Government portals which give easy access to their marketplace and e-tenders

- There is a One Time Settlement Fee for non-paid amounts of MSME

- The MSME registration will help the MSMEs in availing the benefits of government schemes such as the Credit Guarantee Scheme, Credit Linked Capital Subsidy Scheme, Public Procurement Policy, Protection against delayed payments, etc.

- MSMEs are eligible for priority sector lending from banks

- MSMEs get the benefit of a government security deposit waiver that is helpful while participating in e-tenders

- Any number of activities, including service or manufacturing or both, may be added or specified in one MSME registration

- Barcode registration subsidy

- Exemption scheme from direct taxes

- ISO certification fees reimbursement

- Electricity bills concession

- Special consideration in International trade fairs

WHO CAN APPLY FOR UDYAM REGISTRATION?

All manufacturing, service industries, wholesale, and retail trade that fulfil the revised MSME classification criteria of annual turnover and investment can apply for MSME registration. Thus, the MSME registration eligibility depends on an entity’s annual turnover and investment. The following entities are eligible for MSME registration:

- Individuals, startups, business owners, and entrepreneurs

- Private and public limited companies

- Sole proprietorship

- Partnership firm

- Limited Liability Partnerships (LLPs)

- Self Help Groups (SHGs)

- Co-operative societies

- Trusts

LIST OF DOCUMENTS REQUIRED:

- PAN card

- Aadhaar card

- Proof of business registration or Incorporation certificate

- Address proof of the place of business

- Identity and address proof of promoters/director

- Bank Account statement/Cancelled cheque

- Digital signature

- Letter of authorization/Board resolution for authorized signatory

- No objection certificate from the owner of the property

IMPORTANT:

GST registration is not compulsory for enterprises that do not require a GST registration under the GST law. However, enterprises that mandatorily need to obtain GST registration under the GST law, must enter their GSTIN for obtaining the MSME Registration.

DISCLAIMER:

The materials provided herein are solely for information purposes. No attorney-client relationship is created when you access or use the site or the materials. The information presented on this site does not constitute legal or professional advice. It should not be relied upon for such purposes or used as a substitute for legal advice from an attorney licensed in your state.