Common GST Registration Mistakes: Guide to Amendments and Fixes

Introduction

GST registration is important for Businesses as it promotes transparency, streamlines interstate trade, and allows SMEs to claim input tax credits, lowering overall costs. GST registration also enhances business credibility and opens doors to larger markets, boosting growth opportunities.

Businesses registered under GST are required to provide accurate details about their business such as Name, address, Business type, Authorized signatory, etc. in the GST portal. If GST registration details are incorrect, it can trigger audits, ITC rejections, GSTIN cancellations, or even penalties up to ₹25,000/- under Section 125 of the CGST/SGST Act.

Categories of Amendments

GST amendments are changes made to a taxpayer’s registered details on the GST system to correct the GST registration mistakes. The following are the three types of amendments:

- Amendment of Registration Core Fields: Changes that require approval from the tax officer.

- Amendment of Registration Non-core fields: Changes that do not require approval.

- Restricted Amendments: Certain fields cannot be changed and you are required to apply for new registration.

Here are the most common GST registration mistakes you should avoid

1. Mistakes in the Core field (Require Approval for Amendment)

- Mismatch in Business name: It can happen when your submitted documents and registrations have different Business name.

- Inaccurate Business Address: Entering the wrong business address and not including Additional places of business (If your business has multiple branches).

- Incorrect details of Business partners/Directors: Personal details of proprietors or Directors like Name and address.

2. Mistakes in the Non-core field (No Approval Required for Amendment)

Mistakes like wrong (mobile number, Email ID, and Bank details) come under the Non-core fields. Though it does not require approval from the Tax officer to make an Amendment, it can delay GST registration process.

3. Mistakes that cannot be changed (Requires new registration)

- Incorrect PAN details: Filling in wrong or incorrect PAN details may lead to a penalty.

- Incorrect Business Classification: Every Business is different and has various tax rates. Selecting the wrong classification may lead to complications in GST registration.

- State Jurisdiction Mistakes: Registering under the wrong GST jurisdiction can result in application rejection.

Step-by-step guidance to correct GST errors (GST amendments process)

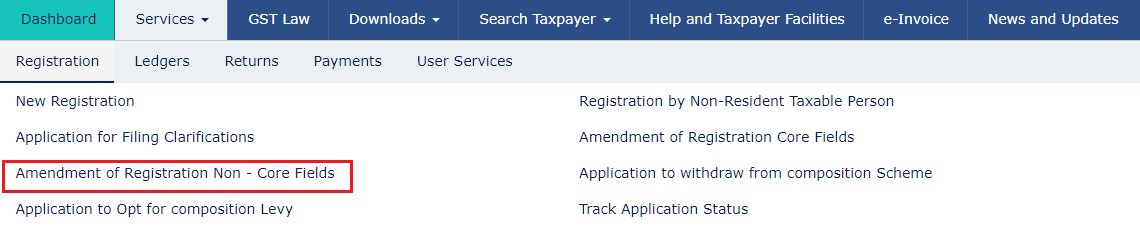

Step 1: Log in to the GST portal and navigate to Services > Registration > Amendment of Registration Core Fields or Amendment of Registration Non-Core Fields.

Navigating to core fields

Navigating to non-core fields

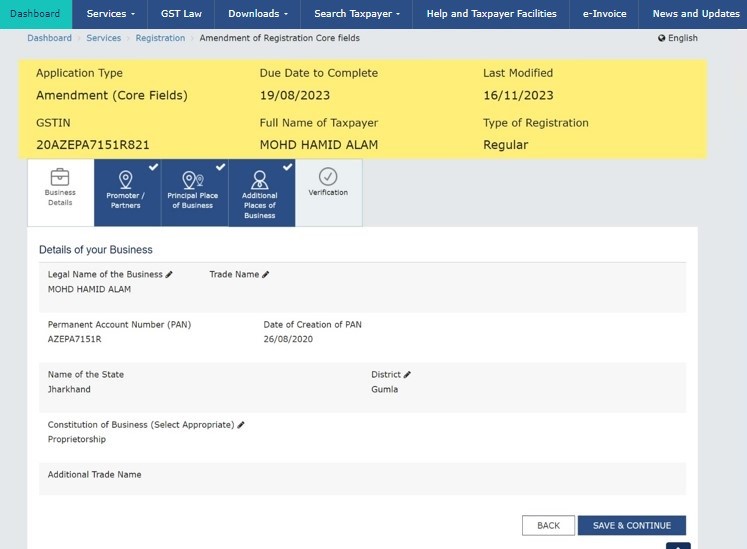

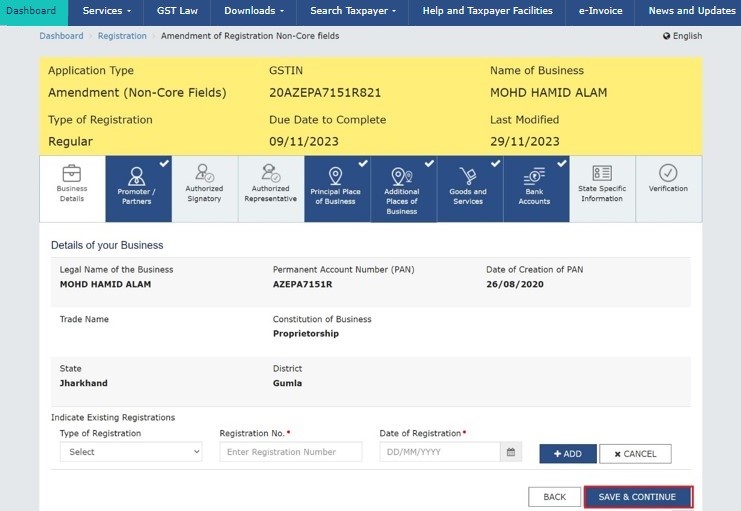

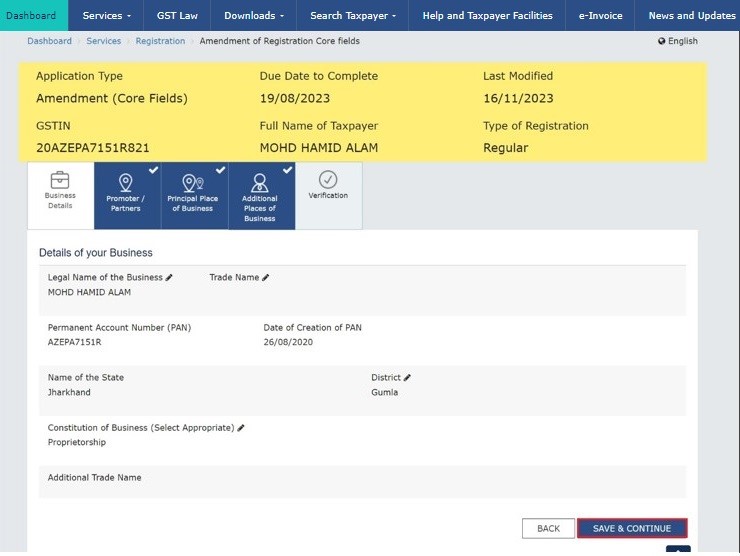

Step 2: Select the relevant section depending on the required Amendment.

Sections in core fields

Sections in non-core fields

Step 3: Make the necessary amendments – Add, delete, or edit details and upload the supporting documents.

Step 4: Complete verification through the authorized signatory using DSC, e-signature, or EVC.

Within 15 minutes of submission, you will receive an ARN (Application Reference Number) via Email and SMS.

Conclusion:

Making GST registration Amendments immediately isn’t just about GST compliance, it’s about protecting your Business from penalties and legal hassles.

Avoid common GST registration errors by consulting with Chhota CFO’s experts.

Frequently Asked Questions

1. How much time does it take for GST amendment?

It will take up to 15 days from the date of change, for core fields to get approved. Non-core fields get updated immediately.

2. Are there any charges for updating GST details?

No, the GST registration amendment is free of cost.

3. Can the PAN number and state be changed?

No, the PAN number and state cannot be changed. The applicant has to file for a new registration.

4. How can I change Bank account details in GST registration?

You can change Bank details by filing a non-core amendment application.

5. Can I delete the Primary authorized signatory?

Primary Authorized Signatory can be deleted subject to the condition that a new Primary Signatory is added/ provided.

6. How many times can I update my GST details?

There is no limit. However frequent updates may cause scrutiny for tax authorities.

7. Can I add a new partner/director to the GST portal?

Yes, Navigate to the promoters/partner section in the Amendment core fields section and update details.