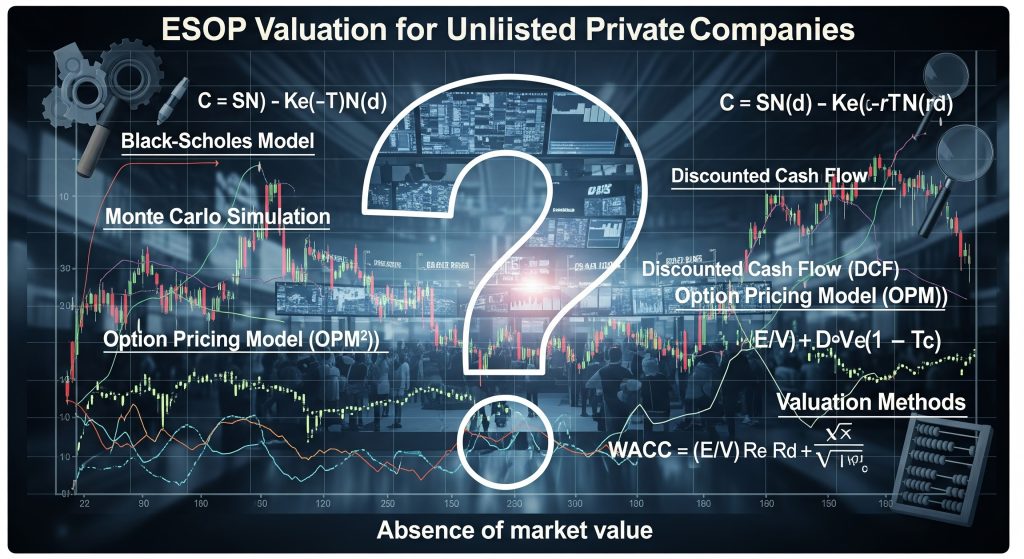

ESOP valuation for unlisted private companies: When you don’t have market value

If you’re building an unlisted company—especially a startup—ESOPs aren’t just a perk. They’re your talent magnet, retention engine, and a promise that growth will be shared. But without a public market price, how do you value those options in a way that’s fair, compliant, and compelling? This guide breaks down the valuation approaches, Indian regulations, tax rules, and practical workflows so you can set ESOPs with confidence.

Why ESOP valuation for unlisted companies is uniquely challenging

Unlisted companies don’t have a quoted share price, which means employees can’t “see” value daily. You need a defensible Fair Market Value (FMV) to:

- Price options and grants: Set exercise price, discount, or premium in a way that reflects risk and upside.

- Comply with Indian tax law: Determine perquisite value at exercise and capital gains later.

- Align stakeholders: Provide transparency for boards, investors, and employees.

- Plan exits: Pre-empt dilution, buybacks, secondaries, or eventual IPO/M&A scenarios.

In India, valuation and compliance for ESOPs in unlisted companies are guided by corporate and tax regulations, and typically require certification by a SEBI-registered merchant banker for tax purposes when options are exercised.

Regulatory framework and compliance in India

- Legal basis for ESOPs: ESOPs for unlisted companies in India are governed by Companies Act provisions, board/shareholder approvals, and scheme documentation. Startups and growth-stage companies often deploy ESOPs to conserve cash and align incentives23.

- Tax valuation: For unlisted shares, the FMV used to compute the perquisite at exercise is typically determined by a SEBI-registered merchant banker and applied on the exercise date; this FMV also influences subsequent capital gains calculations123.

- Scheme documentation: ESOP policy, grant letters, vesting conditions, exercise windows, and treatment on termination or change of control must be clearly codified to avoid disputes and ensure transparency13.

In practice, unlisted companies combine corporate approvals with tax-compliant valuations, ensuring FMV integrity for both grants and exercise events.

Core valuation methods used for ESOPs in unlisted companies

Income approach (discounted cash flow)

- Concept: Estimate future free cash flows and discount them to present value using a risk-adjusted discount rate.

- Use case: Works well for cash-generating businesses or those with clear forecast visibility.

- Key inputs:

- Cash flows: Revenue growth, margins, working capital, capex.

- Discount rate: Often the weighted average cost of capital (WACC).

- Terminal value: Based on long-term growth assumptions.

- Equity value to per-share value:

[ \text{Equity Value} = \sum_{t=1}^{n} \frac{FCF_t}{(1 + r)^t} + \frac{TV}{(1 + r)^n} ]

[ \text{Per-Share Value} = \frac{\text{Equity Value} – \text{Net Debt}}{\text{Fully Diluted Shares}} ] - Pros/cons: Highly sensitive to assumptions; defensible if forecasts are robust.

Market approach (comparables and transactions)

- Comparable companies: Apply valuation multiples like EV/Revenue or EV/EBITDA from similar listed peers or recent private transactions to your metrics.

- Precedent transactions: Use deal multiples from similar sectors/stages to triangulate value.

- Per-share derivation:

[ \text{Equity Value} = \text{Metric} \cdot \text{Multiple} – \text{Net Debt} ]

[ \text{Per-Share Value} = \frac{\text{Equity Value}}{\text{Fully Diluted Shares}} ] - Pros/cons: Market-grounded but requires careful adjustments for size, growth, liquidity, and control premiums.

Asset approach (net asset value)

- Concept: Value the company based on the fair value of assets minus liabilities.

- Use case: Suitable for asset-heavy businesses or early-stage companies without reliable cash flow projections.

- Pros/cons: Conservative; may understate value for growth businesses.

Option pricing for ESOPs

- Why it matters: ESOPs are options, not shares. Their value depends on share FMV, exercise price, volatility, time to expiry, and dividends.

- Black–Scholes baseline:

[ C = S_0 N(d_1) – K e^{-rT} N(d_2) ]

where

[ d_1 = \frac{\ln(S_0/K) + (r + \sigma^2/2)T}{\sigma \sqrt{T}}, \quad d_2 = d_1 – \sigma \sqrt{T} ]- (S_0): FMV of share

- (K): Exercise price

- (r): Risk-free rate

- (\sigma): Volatility

- (T): Time to maturity

- Adjustments for unlisted shares: Illiquidity discounts, vesting, early exercise, forfeiture risk, and performance conditions.

In India, merchant banker-certified FMV for unlisted shares is required for tax computation at exercise, while companies may use internal or external methods (DCF/market) to set grant prices and internal accounting, ensuring consistency with their ESOP scheme and compliance requirements.

Tax treatment in India: What employees and companies must know

- At exercise (perquisite tax): Employees pay tax on the difference between FMV on the exercise date and the exercise price.

[ \text{Perquisite} = \text{FMV at Exercise} – \text{Exercise Price} ]

That perquisite is added to the employee’s taxable income for the year. For unlisted shares, FMV is generally determined by a SEBI-registered merchant banker for tax purposes123. - At sale (capital gains): When the employee eventually sells the shares, capital gains are computed as sale consideration minus FMV used at exercise (cost basis), with holding period determining short-term vs long-term treatment under applicable rules.

- Company impact: Companies record compensation expense for ESOPs, often measured at grant-date fair value and amortized over vesting. Buybacks, secondaries, and cash settlements have separate accounting and tax consequences.

Many Indian startups use merchant banker valuations to establish FMV at exercise and rely on DCF/market methods to guide grants and employee communication; this split ensures regulatory alignment and operational clarity.

Step-by-step ESOP valuation workflow for unlisted companies

- Define objectives and scope

- Purpose: Grant pricing, financial reporting, tax at exercise, or exit planning.

- Stakeholders: Board, auditors, investors, HR.

- Gather data

- Financials: Audited statements, forecasts, cap table.

- Contracts: ESOP scheme, preference rights, liquidation preferences.

- Market inputs: Peer multiples, risk-free rates, volatility proxies.

- Determine share FMV

- Primary method: DCF or market approach.

- Cross-checks: Precedent rounds, investor term sheets, rights/preferences.

- Adjustments:

- Illiquidity discount: Reflect lack of marketability (often a material percentage).

- Minority discount: If valuing minority stake value instead of control.

- Price the options

- Model: Black–Scholes or binomial for vesting and early-exercise patterns.

- Inputs: FMV (S_0), exercise (K), volatility (\sigma) (use peer proxies if needed), (T), (r).

- Compliance and certification

- Tax FMV: Obtain merchant banker certification for unlisted shares at exercise.

- Documentation: Board/shareholder approvals, grant letters, vesting schedules, disclosures123.

- Communicate clearly to employees

- Plain-language value: Explain FMV, exercise price, vesting, and potential outcomes.

- Scenarios: IPO, acquisition, secondary sales, buybacks.

- Update regularly

- Periodic valuation: Refresh FMV and volatility at least annually or on material events.

- Audit alignment: Keep auditors and board in the loop.

Indian practice expects careful documentation, merchant banker FMV at exercise for tax, and transparent employee communication around ESOP economics.

Numerical example with INR

Assume an unlisted company determines a share FMV of ₹1,200 using DCF and market cross-checks. The company grants ESOPs with an exercise price of ₹600, vesting over 4 years. On the day an employee exercises, a merchant banker certifies FMV at ₹1,500.

- Perquisite at exercise:

[ \text{Perquisite} = 1{,}500 – 600 = 900\ \text{(₹ per share)} ]

If the employee exercises 1,000 options, taxable perquisite = ₹9,00,000 for that year. - Later sale: If the employee sells at ₹1,900 per share, capital gain per share = ₹1,900 − ₹1,500 = ₹400. Aggregate capital gains = ₹4,00,000 (holding period rules apply).

- Company accounting: Grant-date fair value per option (using Black–Scholes) might be, say, ₹500. If vesting is straight-line over 4 years, annual compensation expense per option ≈ ₹125, adjusted for expected forfeitures.

Using merchant banker FMV at exercise ensures tax compliance for unlisted shares, while internal valuation supports grant design and employee communication.

Practical tips to avoid valuation pitfalls

- Be consistent: Use the same core method (e.g., DCF) across periods, with documented reasons when switching or adjusting.

- Triangulate: Cross-validate DCF with market multiples and recent financing terms to avoid unrealistic FMV.

- Model preferences: Account for liquidation preferences, anti-dilution, and participation rights—these can materially reduce common equity value per share.

- Factor illiquidity: Apply reasonable discounts for lack of marketability; unlisted equity is not instantly saleable.

- Refresh on events: Revalue after significant financing, M&A discussions, major revenue shifts, or regulatory changes.

- Educate employees: Explain vesting, cliffs, exercise windows, tax implications, and exit pathways in simple terms with INR examples.

- Get expert certification: For tax at exercise in India, obtain merchant banker FMV for unlisted shares; don’t rely solely on internal models.

ESOP design choices that influence valuation and perception

- Exercise price strategy:

- At-the-money: Exercise price ≈ FMV; balances tax burden and perceived upside.

- Discounted: Lower exercise price increases immediate perquisite at exercise but can boost perceived value.

- Premiumed: Higher exercise price reduces perquisite but may dampen motivation.

- Vesting architecture:

- Time-based: Standard 4-year vesting with 1-year cliff.

- Performance-based: Milestones tied to revenue, EBITDA, product, or strategic goals.

- Hybrid: Combines tenure and KPIs, often better for alignment.

- Liquidity mechanisms:

- Buybacks: Company repurchases vested shares at board-approved FMV; creates tangible liquidity.

- Secondary windows: Allow sales to investors or new shareholders during funding rounds.

- IPO/M&A: Outline what happens to options upon listing or acquisition.

- Employee-centric communication:

- Value narrative: Show how ₹-denominated outcomes could look across scenarios.

- Exercise guidance: Clarify timing, tax, and costs (including any required cash outlay).

- Exit pathways: Provide visibility to reduce uncertainty.

Thoughtful scheme design, clear liquidity pathways, and transparent valuation build trust and make ESOPs truly motivational in unlisted companies.

ESG and governance signals investors look for

- Board oversight: Active compensation committees evaluating grants, dilution, and performance.

- Cap table hygiene: Predictable ESOP pool (often 10–15%), clear refresh policies, and fair allocation.

- Disclosure: Clean, timely disclosures and employee education materials.

- Fairness: Consistency in valuation and grant practices across cohorts.

These governance practices materially influence investor confidence in private rounds and the credibility of your ESOP program.

FAQs: Fast answers to common questions

- Is merchant banker valuation always required?

- For tax at exercise: Yes, for unlisted shares it’s the standard practice in India to use a SEBI-registered merchant banker FMV on the exercise date.

- For grants/accounting: Not strictly required, but external valuations bolster defensibility123.

- Can an alliance or holding company valuation be used?

- No: ESOP valuation must reflect the actual issuing entity’s equity value and specific rights.

- What about STARTUP India or DPIIT recognition?

- Helpful for tax deferral in specific contexts: But you still need compliant FMV determination for unlisted shares at exercise.

- How often should we revalue?

- At least annually, and upon material events such as funding rounds, M&A discussions, or significant performance swings.

- Should we cap INR outcomes for employees?

- Avoid arbitrary caps: Instead, define liquidity mechanisms and empower employees with realistic scenarios and tax planning.

Unlisted company ESOPs in India hinge on robust valuation methods and merchant banker FMV for tax at exercise, supported by clean documentation and employee education.

A concise checklist you can use today

- Objective: Grant pricing, tax, accounting.

- Data: Financials, forecasts, cap table, market inputs.

- Method: Choose DCF or market, cross-check with transactions.

- FMV: Apply illiquidity/minority discounts; document assumptions.

- Option value: Use Black–Scholes or binomial; reflect vesting and risk.

- Certification: Get merchant banker FMV at exercise for unlisted shares.

- Communication: Build INR-based examples; explain liquidity pathways.

- Governance: Board oversight, consistent policies, annual refresh.

Bottom line

You don’t need a market quote to set credible ESOPs. You need a defensible FMV, a disciplined valuation method, merchant banker certification at exercise for tax, and radically clear communication. Do that, and your ESOPs will feel real to employees—worth ₹, not just promises—and will stand up to investor and auditor scrutiny in the journey from unlisted to whatever comes next.

Get Expert Assistance

Related Articles

OSH Code 2020 Guide: India Workplace Safety for Employers & Workers

OSH Code 2020 Guide: India Workplace Safety for Employers & Workers 90 Days Work Rule for Gig Workers: Everything You Need to Know About India’s New Social Security Framework (2026)

90 Days Work Rule for Gig Workers: Everything You Need to Know About India’s New Social Security Framework (2026) Stop Filing Director KYC Every Year: New Once in 3 Years Rule Starts March 2026

Stop Filing Director KYC Every Year: New Once in 3 Years Rule Starts March 2026 GST on Services Without Forex Receipt: DHL Express Delhi High Court Ruling Explained

GST on Services Without Forex Receipt: DHL Express Delhi High Court Ruling Explained Income Tax Department Access to Social Media and Emails from April 1, 2026: What Really Changes?

Income Tax Department Access to Social Media and Emails from April 1, 2026: What Really Changes?

Recent Articles

OSH Code 2020 Guide: India Workplace Safety for Employers & Workers

OSH Code 2020 Guide: India Workplace Safety for Employers & Workers 90 Days Work Rule for Gig Workers: Everything You Need to Know About India’s New Social Security Framework (2026)

90 Days Work Rule for Gig Workers: Everything You Need to Know About India’s New Social Security Framework (2026) Stop Filing Director KYC Every Year: New Once in 3 Years Rule Starts March 2026

Stop Filing Director KYC Every Year: New Once in 3 Years Rule Starts March 2026 GST on Services Without Forex Receipt: DHL Express Delhi High Court Ruling Explained

GST on Services Without Forex Receipt: DHL Express Delhi High Court Ruling Explained Income Tax Department Access to Social Media and Emails from April 1, 2026: What Really Changes?

Income Tax Department Access to Social Media and Emails from April 1, 2026: What Really Changes?

Contact Us

- 50, Bright Arcade, 12th Main Rd, 4th T Block East, KV Layout, Jayanagar, Bengaluru – 560011, Karnataka

- +91 97397 36999

- mgmt@chhotacfo.com

Useful Links

©2024.CHHOTA CFO - All rights reserved