Appointment of Cost Auditor and Maintenance of Cost Audit Records

In today’s complex business landscape, simply making a profit is no longer enough. Companies must demonstrate efficiency, transparency, and regulatory compliance to remain competitive and build stakeholder trust. The statutory cost audit, governed by Section 148 of the Companies Act, 2013, is a critical tool for achieving this. It mandates a systematic review of a company’s cost accounting records for specified industries to ensure accuracy, proper cost control, and efficiency.

This guide breaks down the rules for cost audit applicability, focusing on the industries and turnover thresholds outlined in the Companies (Cost Records and Audit) Rules, 2014, with special emphasis on Tables A and B.

What is a cost audit?

A cost audit is the verification of a company’s cost accounts to ensure that cost accounting principles and objectives have been adhered to. It goes beyond the traditional financial audit to provide a detailed, independent assessment of a company’s cost structure. A qualified Cost Accountant, appointed by the Board of Directors, conducts the audit and reports their findings to the company and the government.

Cost Record Maintenance vs. Cost Audit

Companies in industries listed in Table A or B must maintain cost records if their overall turnover was ₹35 crore or more in the preceding financial year. A cost audit is required if a company also meets specific, higher turnover criteria.

Determining Applicability with Table A and B

Cost audit requirements vary based on whether a company falls under the Regulated Sector (Table A) or Non-Regulated Sector (Table B).

- Regulated Sector (Table A): A cost audit is mandated if the company’s preceding financial year turnover meets certain thresholds.

- Non-Regulated Sector (Table B):Similar to Table A, non-regulated sectors require a cost audit if specific turnover limits from the preceding financial year are exceeded.

Application of Cost Records.- For the purposes of sub-section (1) of section 148 of the Act, the class of companies, including foreign companies defined in clause (42) of section 2 of the Act, engaged in the production of the goods or providing services, specified in the Table below, having an overall turnover from all its products and services of rupees thirty five crore or more during the immediately preceding financial year, shall include cost records for such products or services in their books of account, namely:-

Regulated Sectors:

SL.NO | Industry/ Sector/ Product/ Service | Customs Tariff Act Heading(substituted vide Companies (cost records and audit) Second Amendment Rules, 2017 effective from 01.07.2017) |

1. | Telecommunication services made available to users by means of any transmission or reception of signs, signals, writing, images and sounds or intelligence of any nature and regulated by the Telecom Regulatory Authority of India under the Telecom Regulatory Authority of India Act, 7997 (24 of 1997); including activities that requires authorization or license issued by the Department of Telecommunications, Government of India under Indian Telegraph Act, 1885 (13 of 1885);

| Not applicable |

2. | Generation, transmission, distribution and supply of electricity regulated by the relevant regulatory body or authority under the

| Generation-27t6; Other Activity-Not Applicable |

3. | Petroleum products; including activities regulated by thePetroleum and Natural Gas Regulatory Board under thePetroleum and Natural Gas Regulatory Board Act,2006 (19 of

| 2709 to 27L5; Other Activity-Not Applicable |

4. | Drugs and pharmaceuticals; | 2901 to 2942; 3001 to 3006. |

5. | Fertilizers; | 3102 to 3105 |

6. | Sugar and industrial alcohol; | 1701; 1703; 2207. |

Non-Regulated Sectors:

Sl.No. | Industry/ sector/ Product/ Service | Customs Tariff Act Heading(substituted vide Companies (cost records and audit) Second Amendment Rules, 2017 effective from 01.07.2017) |

1. | Machinery and mechanical appliances used in defense, space and atomic energy sectors excluding any ancillary item or items; | 8401; 8801 to 8805;8901 to 8908. |

2. | Turbo jets and turbo propellers; | 8411 |

3. | Arms, ammunitions and Explosives | 3601 to 3603; 9301 to 9306 |

4. | Propellant powders; prepared explosives (other than | 3601 to 3603 |

5. | Radar apparatus, radio navigational aid apparatus and radio remote control apparatus; | 8526 |

6. | Tanks and other armoured fighting vehicles, motorised, whether or not fitted with weapons and parts of such vehicles, that are funded (investment made in the company) to the extent of ninety per cent or more by the Government or Government agencies; | 8710 |

7. | Port services of stevedoring, pilotage, hauling, mooring, re-mooring, hooking, measuring, loading and unloading services rendered for a Port in relation to a vessel or goods regulated by the Tariff Authority for Major Ports under the Major Port trusts Act, 1963 (38 of 1963);(substituted vide Companies (Cost Records and Audit) Amendment Rules, 2018 dated 03.12.2018) | Not applicable |

8. | Aeronautical services of air traffic management, aircraft operations, ground safety services, ground handling, cargo facilities and supplying fuel rendered by airports and regulated by the Airports at the Airports ;(substituted vide Companies (Cost Records and Audit) Amendment Rules, 2018 dated 03.12.2018) Economic Regulatory Authority under the Airports Economic Regulatory Authority of India Act,2008 (27 of 2008); | Not applicable |

9. | lron and Steel; | 7201 to 7229; 73O7 to 7326 |

10. | Roads and other infrastructure projects corresponding to para No. (1) (a) as specified in Schedule Vl of the Companies Act, 2013 (18 of 2013); | Not applicable. |

11. | Rubber and allied products; including products | 4001 to 4017 |

12. | Coffee and tea; | 0901 to 0902 |

13. | Railway or tramway locomotives, rolling stock, | 8601 to 8608, 8609 (inserted vide Companies (Cost Records and Audit) Amendment Rules, 2018 dated 03.12.2018) |

14. | Cement; | 2523; 6811 to 5812 |

15. | Ores and Mineral products; | 2502 to 2522; 2524 to 2526; |

16. | Mineral fuels (other than petroleum), mineral oils etc; | 2707 to 2708 |

17. | Base metals; | 7401 to 7403 ;7405 to 7473; |

18. | Inorganic chemicals, organic or inorganic compounds | 2801 to 2853; 2901. to 2942; |

19. | Jute and Jute Products; | 5303, 5307 (inserted vide Companies (Cost Records and Audit) Amendment Rules, 2018 dated 03.12.2018), 5310 |

20. | Edible Oil; | 1507 to 1518 |

21. | Construction Industry as per para No. (5) (a) as | Not applicable. |

22. | Health services, namely functioning as or running | Not applicable. |

23. | Education services, other than such similar services | Not applicable. |

24. | Milk powder; | 0402 |

25. | Insecticides; | 3808 |

26. | Plastics and polymers; | 3901 to 3914; 3916 to 3921;3925 |

27. | Tyres and tubes; | 4011 to 4013 |

28. | Pulp and Paper (substituted vide Companies (Cost Records and Audit) Amendment Rules, 2018 dated 03.12.2018) | 4701 to 4704 (inserted vide Companies (Cost Records and Audit) Amendment Rules, 2018 dated 03.12.2018), 4801 to 4802 |

29. | Textiles; | 5004 to 5007; 5106 to 5113; 52O5 to 5212; 5303;5307 (inserted vide Companies (Cost Records and Audit) Amendment Rules, 2018 dated 03.12.2018) 5310; |

30. | Glass; | 7003 to 7008: 7017;7076 |

31. | Other machinery and Mechanical Appliances; | 8402 to 8487 |

32. | Electricals or electronic machinery; | 8501 to 8507:8511 to 8512:8514 to 8515; 8517; 8525 to 8536: 8538 to 8547. |

33. | Production, import and supply or trading of following

|

|

Provide that nothing contained in serial number 33 shall apply to foreign companies having only liaison offices

Provided further that nothing contained in this rule shall apply to a company which is classified as a micro enterprise or a small enterprise including as per the turnover criteria under sub-section (9) of section 7 of the Micro, Small and Medium Enterprises Development Act,2006 (27 of 2006)

Applicability for cost audit.- (1) Every company specified in the item (A) of rule 3 shall be required to get its cost records audited in accordance with these rules if the overall annual turnover of the company from all its products and services during the immediately preceding financial year is rupees fifty crore or more and the aggregate turnover of the individual product or products or service or services for which cost records are required to be maintained under rule 3 is rupees twenty five crore or more

(2) Every company specified in item (B) of rule 3 shall get its cost records audited in accordance with these rules if the overall annual turnover of the company from all its products and services during the immediately preceding financial year is rupees one hundred crore or more and the aggregate turnover of the individual product or products or service or services for which cost records are required to be maintained under rule 3 is rupees thirty five crore or more.

(3) The requirement for cost audit under these rules shall not apply to a company which is covered in rule 3, and-

(i) Whose revenue from exports, in foreign exchange, exceeds seventy five percent of its total revenue; or

(ii) which is operating from a special economic zone.

(iii) which is engaged in generation of electricity for captive consumption through Captive Generating PIant. For this purpose, the term “Captive Generating Plant” shall have the same meaning as assigned in rule 3 of the Electricity Rules, 2005″;

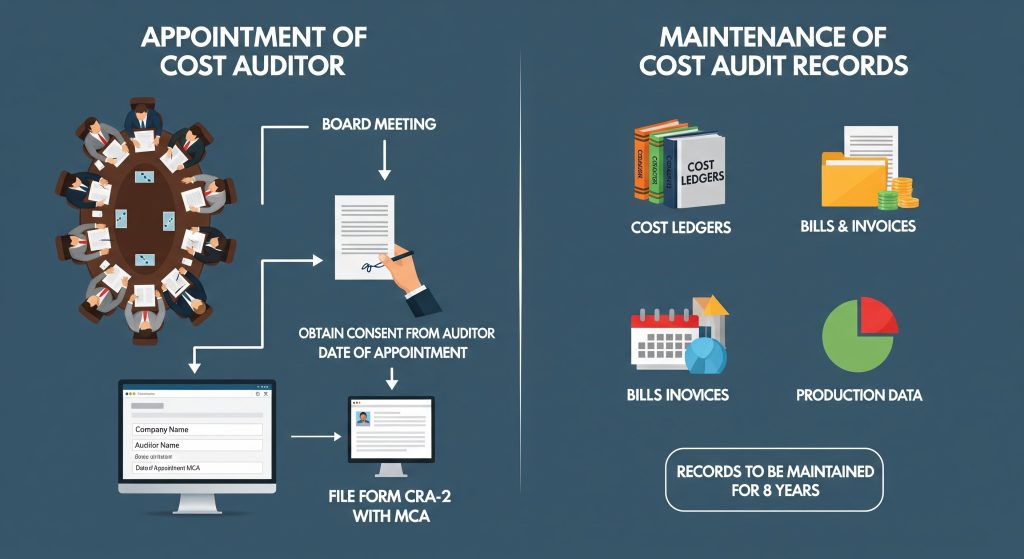

Maintenance of records.- (1) Every company under these rules including all units and branches thereof, shall, in respect of each of its financial year commencing on or after the 1st day of April, 2014, maintain cost records in form CRA-1.

Provided that in case of company covered in serial number 12 and serial numbers 24 to 32 of item (B) of rule 3, the requirement under this rule shall apply in respect of each of its financial year commencing on or after 1st Day of April,2015

(2) The cost records referred to in sub-rule (1) shall be maintained on regular basis in such manner as to facilitate calculation of per unit cost of production or cost of operations, cost of sales and margin for each of its products and activities for every financial year on monthly or quarterly or half-yearly or annual basis.

(3) The cost records shall be maintained in such manner so as to enable the company to exercise, as far as possible, control over the various operations and costs to achieve optimum economies in utilisation of resources and these records shall also provide necessary data which is required to be furnished under these rules.

Cost audit.– (1) The category of companies specified in rule 3 and the thresholds limits laid down in rule 4, shall within one hundred and eighty days of the commencement of every financial year, appoint a cost auditor.

Provided that before such appointment is made, the written consent of the cost auditor to such appointment, and a certificate from him or it, as provided in sub-rule (1.A), shall be obtained.

(1A) The cost auditor appointed under sub-rule (1) shall submit a certificate that-

(a) the individual or the firm, as the case may be, is eligible for appointment and is not disqualified for appointment under the Act, the Cost and Works Accountants Act, 1959 (23 of 1959) and the rules or regulations made thereunder;

(b) the individual or the firm, as the case may be, satisfies the criteria provided in section 141 of the Act, so far as may be applicable;

(c) the proposed appointment is within the limits laid down by or under the authority of the Act; and

(d) the list of proceedings against the cost auditor or audit firm or any partner of the audit firm pending with respect to professional matters of conduct, as disclosed in the certificate, is true and correct.

(2) Every company referred to in sub-rule (1) shall inform the cost auditor concerned of his or its appointment as such and file a notice of such appointment with the Central Government within a period of thirty days of the Board meeting in which such appointment is made or within a period of one hundred and eighty days of the commencement of the financial year, whichever is earlier, through electronic mode, in form CRA-2, along with the fee as specified in Companies (Registration Offices and Fees) Rules, 2014.

(3) Every cost auditor appointed as such shall continue in such capacity till the expiry of one hundred and eighty days from the closure of the financial year or till he submits the cost audit report, for the financial year for which he has been appointed.

Provided that the cost auditor appointed under these rules may be removed from his office before the expiry of his term, through a board resolution after giving a reasonable opportunity of being heard to the Cost Auditor and recording the reasons for such removal in writing;

Provided further that the Form CRA-2 to be filed with the Central Government for intimating appointment of another cost auditor shall enclose the relevant Board Resolution to the effect: Provided also that nothing contained in this sub-rule shall prejudice the right of the cost auditor to resign from such office of the company

(3A) Any casual vacancy in the office of a cost auditor, whether due to resignation, death or removal, shall be filled by the Board of Directors within thirty days of occurrence of such vacancy and the company shall inform the Central Government in Form CRA-2 within thirty days of such appointment of cost auditor

(3B) The cost statements, including other statements to be annexed to the cost audit report, shall be approved by the Board of Directors before they are signed on behalf of the Board by any of the director authorised by the Board, for submission to the cost auditor to report thereon

(4) Every cost auditor, who conducts an audit of the cost records of a company, shall submit the cost audit report along with his or its reservations or qualifications or observations or suggestions, if any, in form CRA-3.

(5) Every cost auditor shall forward his duly signed report to the Board of Directors of the company within a period of one hundred and eighty days from the closure of the financial year to which the report relates and the Board of Directors shall consider and examine such report, particularly any reservation

(6) Every company covered under these rules shall, within a period of thirty days from the date of receipt of a copy of the cost audit report, furnish the Central Government with such report along with full information and explanation on every reservation or qualification contained therein, in Form CRA-4 in Extensible Business Reporting Language format in the manner as specified in the Companies (Filing of Documents and Forms in Extensible Business Reporting language) Rules, 2015 along with fees specified in the Companies (Registration Offices and Fees) Rules, 2014.”.

The provisions of sub-section (12) of section 143 of the Act and the relevant rules made thereunder shall apply mutatis mutandis to a cost auditor during performance of his functions under section 148 of the Act and these rules.

Rules not to apply in certain cases.– The requirement for cost audit under these rules shall not be applicable to a company which is covered under rule 3, and,

(i) whose revenue from exports, in foreign exchange, exceeds seventy five per cent of its total revenue or

(ii) which is operating from a special economic zone.

Exemptions from Cost Audit

A company that meets the turnover criteria may be exempt if:

- Its export revenue in foreign exchange exceeds 75% of its total revenue.

- It is operating from a Special Economic Zone (SEZ).

Penalties for Non-Compliance

This section establishes clear penalties for companies, officers, and cost auditors who fail to comply with the provisions of Section 148.

Penalty on Company and Officers

If the company or its officers fail to comply, they will be liable for punishment in the same manner as provided under Section 147(1), which includes:

Fine on the company: Rs.25,000 to Rs.5,00,000.

Fine on each officer in default: Rs.10,000 to Rs.1,00,000.

Penalty on Cost Auditor

If the cost auditor fails to comply with the requirements under Section 148, they will be liable for punishment in the same manner as under Section 147(2) to 147(4), including:

Fine: Rs.25,000 to Rs.5,00,000 (or 4 times the remuneration, whichever is less).

Enhanced penalties (including imprisonment up to 1 year and higher fines) if the violation is found to be deliberate, fraudulent, or intended to deceive.