Internal Audit

An impartial service that assesses an organization’s internal controls, corporate procedures, processes, and methods is known as internal audit. An internal audit assists in ensuring adherence to the many laws that apply to a company. An organisation can set up its financial statements and records in accordance with the applicable legal standards and reporting.

Understanding Internal Audit

An internal audit’s goal is to evaluate an organization’s operational standards and effectiveness. An organisation could establish guidelines for carrying out tasks like placing orders, accepting delivery, and paying bills. Knowing if staff adhere to internal operational standards is another benefit of conducting an internal audit. An internal audit assists in locating issues or inefficiencies so that appropriate corrective action can be taken. Internal audits can spot any staff scams, such money embezzlement. The audit can also reveal whether cost overruns are being done on purpose and whether a specific vendor is receiving preferential treatment over other low-cost suppliers. It could be necessary to track how frequently employees switch between various roles and responsibilities. Any possible hazards or monetary losses can be examined via an internal audit. A company can close off financial leaks. Before the required audit, the process permits the discovery and rectification of a procedure lapse. A quarterly, monthly, or annual internal audit is possible. The decision is based on the organization’s requirements. In some circumstances, such as those covered by the Companies Act of 2013, a firm is required to appoint an internal auditor. An internal auditor may use a variety of evaluation or analysis techniques when conducting an internal audit.What are the Benefits of Internal Audit?

- As it monitors the organization’s internal control, it safeguards the assets and lowers the likelihood of fraud.

- It also acts as an early warning system that helps the business to recognise flaws and promptly implement fixes.

- Operations become more efficient as a result.

- It improves the integrity and dependability of the finances.

- It makes sure that the company abides by all applicable laws and rules.

- The monitoring methods are examined by the internal audit system.

- Additionally, it aids in lowering the danger of data breaches and other cyber security issues.

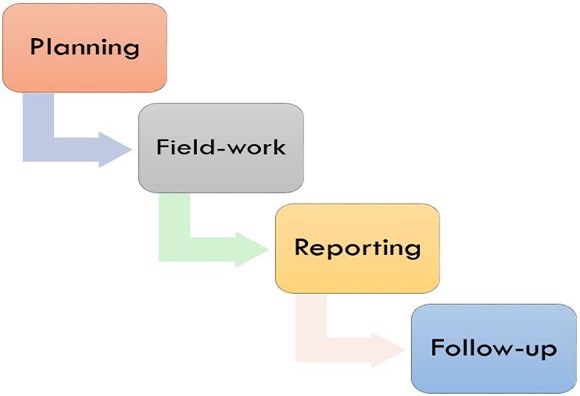

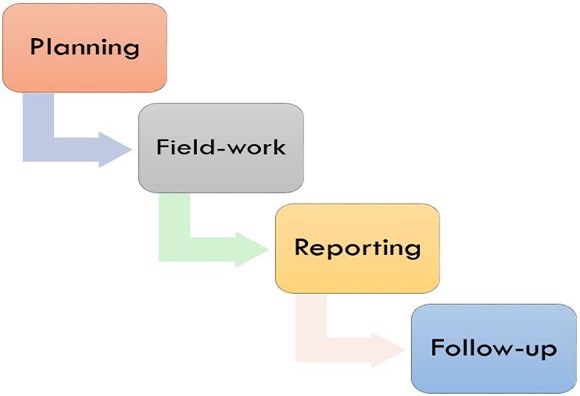

What is the Procedure to Conduct Internal Audit?

- Planning: In the course of the planning process, the audit team will describe the objectives and scope, evaluates instructions related to audit such as law, policies, procedures, etc. The audit plans are performed by analysing the results from past audits and arranging a timetable.

- Field-work: It is a substantial act of internal auditing. During this stage, the audit team will start the audit process by reviewing supporting documents, interviewing department personnel, recognizing exceptions and identifying suggestions for improvement. In the end, the audit department furnishes written feedback and disciplinary action plan for their findings.

- Reporting: It is the third stage of the internal audit process. The auditor will formulate the internal audit report that sum-up and convey the audit results; then issues a draft report discussed with the unit management. After that, accurate, fair, short, and appropriate final report is issued by an auditor.

- Follow-up: It is the final and an important stage of internal audit which is generally ignored. In this stage, management must require time to time monitoring to achieve suggestions and findings determined during the internal audit process. Without proper and timely follow-up process management cannot expect any positive changes.

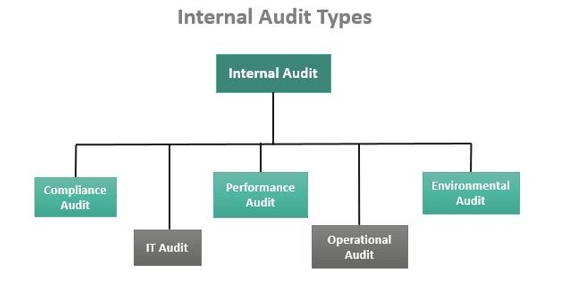

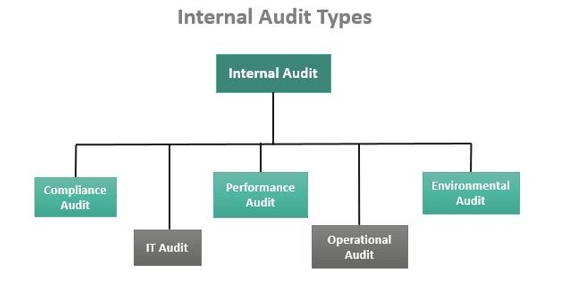

What are the Types of Internal Audits?

- Compliance Audits

- IT Audits

- Performance Audits

- Operational Audits

- Environmental Audits

What can Cause Failures in an Internal Audit?

Internal audit is incredibly helpful for finding gaps, identifying fraud, and reforming systems. However, the following warning signs could result in an internal audit failing:- Difficulties with the scope –

- Not addressing all clients or stakeholders

- Not reviewing the data.

- Objectivity and Independence

The Type of Companies are Required to Conduct Internal Audit in India

Public Company- each and every private business- A Turnover of at least Rs. 200 crore during the previous financial year, At any time of the year

- More than 100 crores of rupees in outstanding loans or borrowing.

Who can be an Internal Auditor for the purpose of Internal Audit?

An internal auditor is a person who performs an internal audit. The Internal auditor for the purpose of audit can be an individual, partnership firm or a body corporate. He/ she can be a Chartered Accountant or Cost Accountant (whether in practice or not) or such other professional that is appointed by the board to conduct an internal audit of the functions and activities of the company. An employee of a company can also be appointed as an internal auditor provided that he possesses requisite qualification and abilities to perform an internal audit. The Functions of Internal Auditor are as follows:- Review operations, procedures, and policies and also assist the management in establishing better policies and procedures.

- Certify risks being managed within acceptable limits as specified by the Board of Directors.

- Examine and evaluate the continuous effectiveness of the internal control system and make proper recommendations, if any, for improving the internal control echanism.

- Help the management in identifying frauds and also preventing them.

What are the Activities involved in Internal Audit?

Generally, an internal audit involves the following activities:- The internal auditor will decide upon and convey to the appropriate management members the audit’s objectives and scope.

- The internal auditors will gain knowledge of the business sector being examined through the use of metrics, objectives, and the type of important transaction, document reviews, and interviews.

- The internal auditor is required to outline the fundamental risks associated with the business operations that fall under the purview of the upcoming audit.

- In order to make sure that the risk is effectively managed and controlled, the internal auditor must pinpoint the management processes.

- To ascertain if the most crucial management controls are performing as intended, the internal auditor must create and implement a risk-based sampling and testing approach.

- He will discuss the identified problems and difficulties with management in order to develop some action plans to deal with such problems.

- Finally, he must conduct timely follow-up on the findings reported in order to determine whether the management has made any efforts. Therefore, the internal audit department keeps a follow-up database for this reason.

Why Should You Take Compliance Help for Internal Audits?

- The auditors are carefully chosen for their audit expertise, client, benefit focus, and business. They are adequately trained and qualified.

- Having an expert work for you will help you save time, money, and internal resources.

- the advantage of getting an outsider’s or impartial perspective on the firm, as well as the chance to get expert advice on your business ideas.

- The audit reports that the auditors produce will be beneficial, clear, and understandable.

- At their subsequent visit, the Auditors will follow up on the findings of the prior audit.

- Our auditors are friendly and willing to help.

- Our audit reports will include compliance scores that may be used to pinpoint areas for improvement and gauge general adherence to your standards.