Free Download Payment Voucher Format | Cash | Bank | Advance

If you are looking Free Download Payment Voucher Format or Free Download for Cash Payment Voucher Format or Bank Payment Voucher then Choota CFO is the best place where you can get the Free Consultation to know its usability. We at ChhotaCfo make sure that your day to day office work should be streamlined in a professional way.

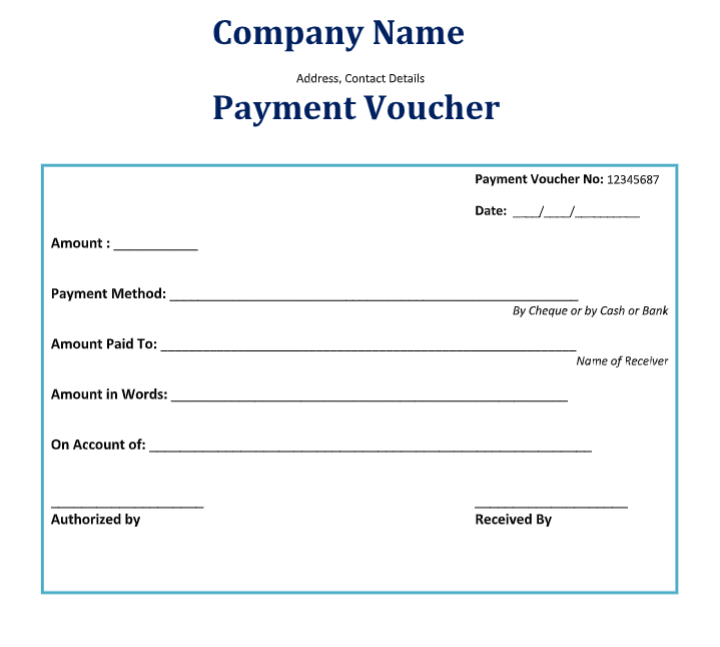

Here in this article you can download different formats of Payment Voucher in Word, Excel & PDF along with different vouchers/invoices inclusive of GST. The type of invoice to be issued depends upon the category of supplies goods and services and you can modify the elements such as company name, color combination and text fonts etc. based on your usability and preference.

Let me explain what is payment voucher and why it is mandatory business practices under Reverse Charge Mechanism (RCM).

What is the Payment Voucher?

There are cases where a registered entity under GST is liable to pay tax under reverse charge mechanism. These would include circumstances where:

- A registered person/entity makes supplies of such nature on which tax is payable under reverse charge mechanism

- Recipient receives supplies from an unregistered person

In those cases, the registered person/entity liable to pay tax is required to issue an invoice for the goods or services received by him from the supplier.

Furthermore, such a registered person receiving supplies is also required to issue a Payment Voucher to the supplier at the time of making payment.

In the above cases, the registered person is liable to make the payment must issue an invoice for the goods and services received by him. Such a registered person receiving the supplies should also issue a Payment Voucher to the unregistered supplier at the time of making the payment. The Supplier cannot issue Tax Invoice so he needs to issue a Payment Voucher.

Let’s understand this with example

Khetan Silk Mill located in Pune purchased raw cotton from Shreekanth Cotton for Rs 2 Lakhs in Delhi at the rate of 5%. In this circumstance, Khetan Silk Mill will have to pay GST under reverse charge. Hence, CGST and SGST would be applicable on reverse charge basis of Rs 10,000 (5% of 2,00,000).

Download Payment Vouchers Sample Format (It’s FREE no strings attached!)

| Formats | FREE Download Links |

| Payment Voucher – Word Format | Download |

| Payment Voucher Template | Download |

| Payment Voucher – Format1 | Download |

| Payment Voucher – PDF Format | Download |

List of Particulars in Payment Voucher

Following are the particulars to be used in Payment Voucher:

- Name, Address and GSTIN of the of the supplier (if registered)

- Unique serial number of the financial year (not exceeding 16 characters )

- Date of issue payment voucher

- Name, Address and GSTIN of the recipient

- Description of goods and services (on which tax is paid on Reverse Charge mechanism)

- Amount paid to the Supplier

- The rate of GST and the amount of tax charged under CGST, SGST and IGST or cess

- Place of Supply, if the transaction is made in interstate mention the state name and state code.

- Signature/Digital Signature of the supplier or the Authorized representative of the supplier.